Increases in energy, transportation and labor costs will lead to continued price increases for food packaging over the next 12 months, as will the conflict between Russia and Ukraine, according to a report published in March by Rabobank.

Surging e-commerce sales are another factor in price increases for paper packaging. Rabobank expects energy costs for paper packaging to increase by 3.4% and production costs to rise by 2.3% to 3.6%. Corn prices have surged amid the Russia-Ukraine war with prices twice as high as two years ago. Corn starch is an essential paper-making chemical in North America.

“Due to the short-term capacity constraints and cost increases, we would not be surprised to see double-digit growth in corrugated prices in 2022,” the report said. “There is, however, ample supply from conversion and greenfield projects expected to come online starting 2023. This will bring some relief to food manufacturers from multi-year inflation, while potentially pressuring margin of corrugated producers.”

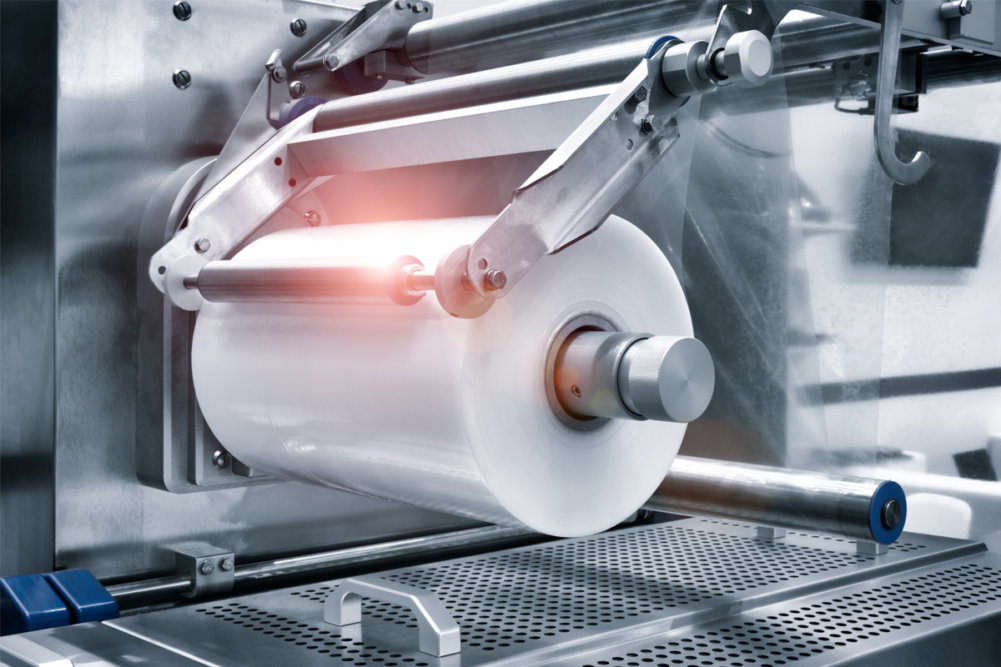

Weather events, infrastructure breakdown, COVID-19 and labor shortages all are causing cost increases in plastic packaging. Prices of major packaging resins, including polyethylene terephthalate (PET), rose by 26¢ a lb, or 49%, in 2021. The Russia-Ukraine war has continued the pressure with regional PET prices increasing by 20¢ a lb in the first two months of this year. New polyethylene plants from Shell Chemicals, a joint venture between ExxonMobil and SABIC, and NOVA Chemicals should come online this year.

Aluminum prices have increased by over 40% in the past two years. This year could bring even higher prices and a potential supply shortage of aluminum cans, according to Rabobank. Rising energy costs are impacting the glass packaging supply chain. Rabobank expects tight supply, especially for wineries, distillers and craft brewers, for the next 12 months.